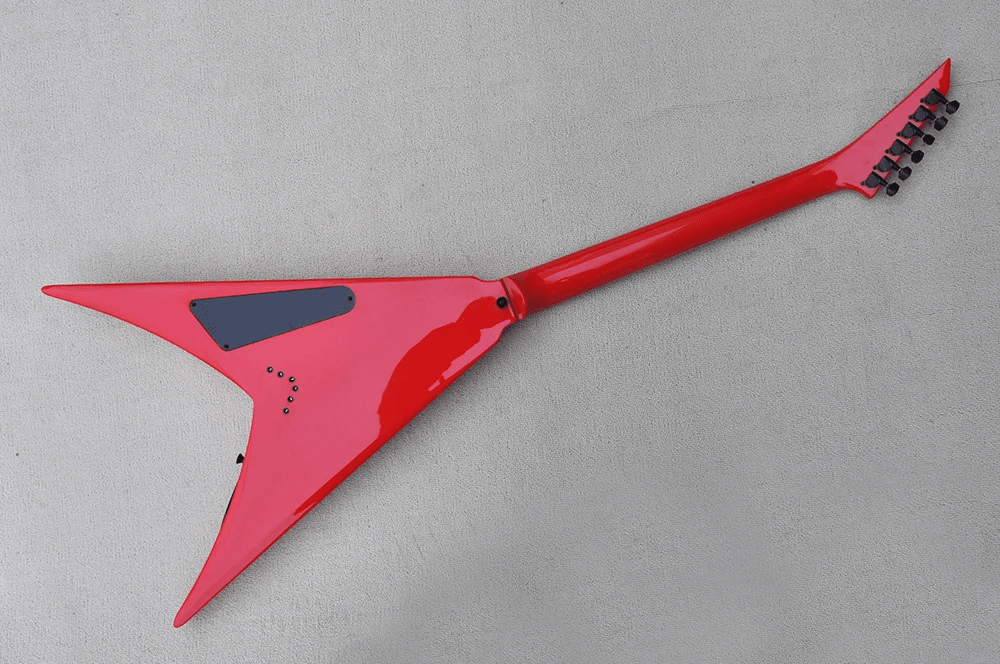

Шикарная Электрогитара, участвовавшая в мюзикле Alan Wake группы The Gods of Asgard. Вечная классика в универсальном дизайне. Ультрасовременная электрогитара серии вошбёрн, которой порадуется любой мужчина. Модельный ряд: 2024 года. Идеальный подарочный вариант для себя и родных!

Технические характеристики:

Преимущества покупки у нас:

Цена: 29 980 р. (оплата при получении)

*Оплата товара производится при получении.

**Вы сможете посмотреть товар перед получением.

**Гарантия 3 года.

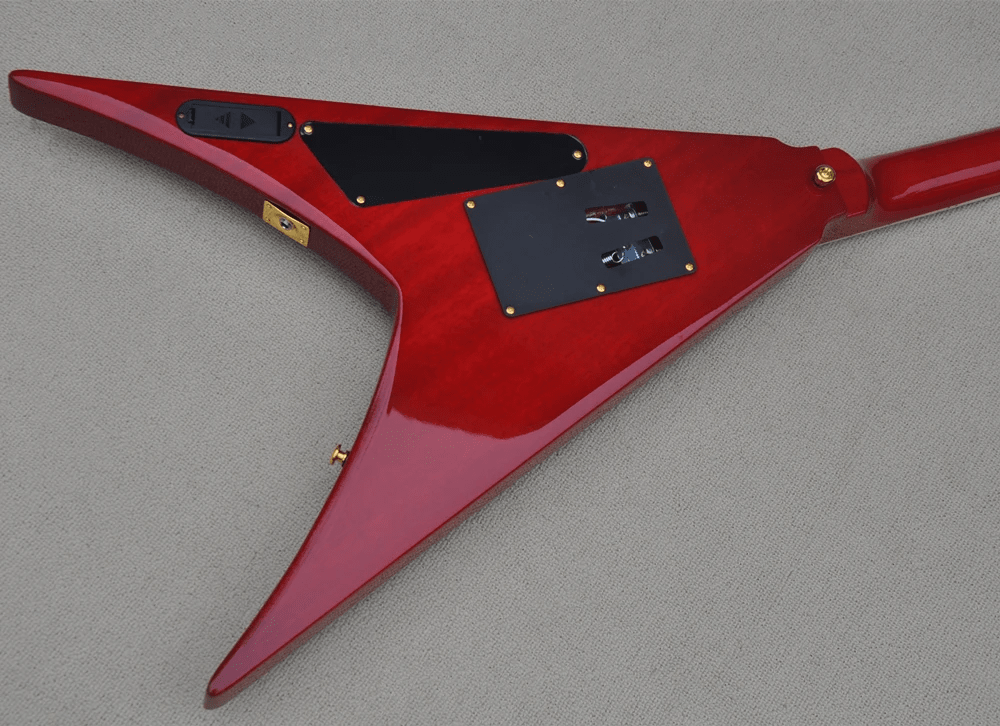

При создании гитары применяется американская липа первого слоя!

Мягкая поверхностная обработка этих гитар способна впечатлить любого взыскательного ценителя.

WASHBURN REDWAKE украсит любой образ рокера и музыканта своим локаничным дизайном и ценителем вселенной Alan Wake!

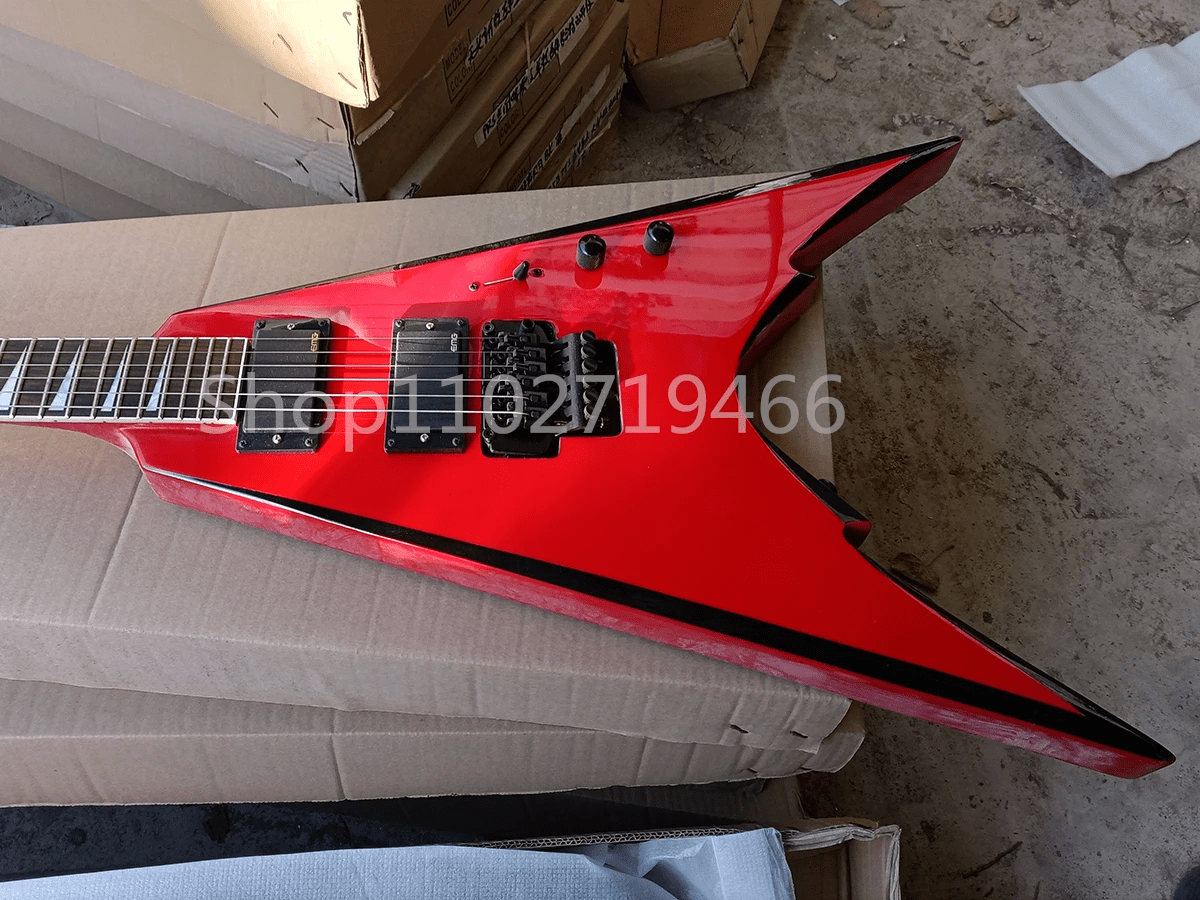

В конструкции гитары находятся качественные керамические звукосниматели, а также тремоло-бридж, накладка из палисандра; мензура - 647.7 мм; 24 лада; Регуляторы: 1 x Volume, 1 x Tone; двойной анкерный стержень. Масса в упаковке: 4.989 кг.

Мужская премиальная электрогитара ценителей всей истории Alan Wake!

Ручная работа и идеальный подарок мужчине - электрогитары Washburn. Установлены качественные керамические звукосниматели, а также тремоло-бридж - модель произведена под начальную спецификацию, прошла тесты на трение, устойчивость поверхности: целостность корпуса подтверждена нагрузкой игры музыкантов - эта прочность и износостойкость с огромным запасом сохранит мужскую электрогитару на годы. Функциональный визуально тонкий дизайн электрогитары используется для певцов, для начинающих гитаристов, и артистов.

Накладка из палисандра; Мензура - 647.7 мм; 24 лада;

Звукосниматели: 3 x Single Coil Pickup;

Регуляторы: 1 x Volume, 1 x Tone;

Двойной анкерный стержень;

Главное достоинство премиальных электрогитар - натуральная липа высшего сорта, приятная на ощупь и долговечная в использовании. На производстве действительно много сложных элементов, которые бережно выполняются вручную!

Современный дизайн и вечная классика!

Электрогитара сочетает классический дизайн с высочайшим качеством изготовления, выполнена из первоклассных материалов по современным технологиям, благодаря чему обладает прекрасным звучанием и внешним видом! Гармонично и стильно сочетается с домашними репетициями, так и в репетиционных залах, а так же на концертах в клубах.

Преимущество покупки электрогитары у нас:

Двойной анкерный стержень;

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ультрасовременная электрогитара из липы серии вошберн, премиум-аксессуар от которого мужчина получит настоящее удовольствие и желанный подарок!

Бесплатная доставка по России!

Гарантия 3 года

Оплата при получении!

Цена: 29 980р.

*Оплата мужской электрогитары при получении.

**Вы можете протестировать электрогитару, прежде чем покупать.

Доставка курьером.